Employment Data

Learn about the employment data that powers Atomic's products. Employment data is delivered to you via webhooks. For your convenience, the data may include both raw and derived fields.

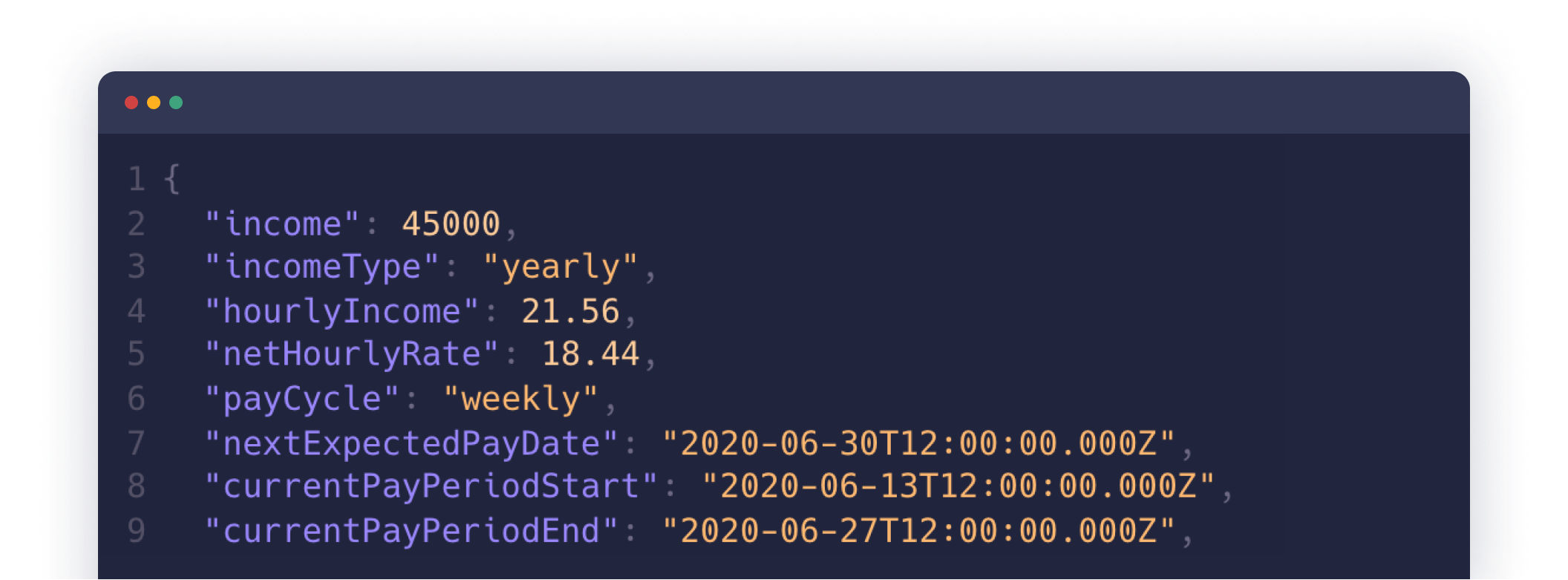

Income

incomenumber- Employee's income, represented as a number.

incomeTypestring- Employee's income type. Possible values are

yearly,monthly,weekly,daily, andhourly. annualIncomenumber- Employee's annual income, represented as a number. This value may be derived.

hourlyIncomenumber- Employee's hourly income, represented as a number. This value may be derived.

netHourlyRatenumber- Employees net hourly income, represented as a number. This value may be derived.

payCyclestring- How frequently the end user gets paid. Possible values are

monthly,semimonthly,biweekly, andweekly. This value may be derived. nextExpectedPayDatedate- Next expected paycheck date for the employee in ISO format. This value may be derived.

currentPayPeriodStartdate- The start date of the current pay period in ISO format. This value may be derived.

currentPayPeriodEnddate- The end date of the current pay period in ISO format. This value may be derived.

unpaidHoursInPayPeriodnumber- The number of hours the employee has worked in the current pay period which are to be paid out in the next pay cycle. This is only available for hourly employees. This value may be derived.

{

"income": 45000,

"incomeType": "yearly",

"annualIncome": 45000,

"hourlyIncome": 21.56,

"netHourlyRate": 18.44,

"payCycle": "weekly",

"nextExpectedPayDate": "2020-06-30T12:00:00.000Z",

"currentPayPeriodStart": "2020-06-13T12:00:00.000Z",

"currentPayPeriodEnd": "2020-06-27T12:00:00.000Z",

"unpaidHoursInPayPeriod": 24

}Statements

statements[Statement]- An array of statement objects. For date fields, we will return whichever of

date,payPeriodStartDate, andpayPeriodEndDateare available, depending on the statement provider.Child Properties

Optional Properties

datestringDate of the deposit in ISO 8601 format.grossAmountnumberGross dollar amount of the deposit.hoursnumberHours worked within the pay period.netAmountnumberNet dollar amount of the deposit.payPeriodEndDatestringEnding date of the pay period in ISO 8601 format.payPeriodStartDatestringStarting date of the pay period in ISO 8601 format.ytdGrossAmountnumberYear to date gross dollar amount of the deposit.ytdNetAmountnumberYear to date net dollar amount of the deposit.paymentMethodstringMethod used for the payment. Possible values includedepositorcheck.deductions[Deduction]An array ofDeductionobjects, describing paycheck deductions such as taxes and benefits. Not all deductions will have bothamountandytdAmountavailable. We will extract all values available to us in the payroll system.Child Properties

Required Properties

categorystring- Category of the deduction such as

taxes,benefits, orretirement. rawLabelstring- The label for the deduction, exactly as given by the payroll provider.

labelstring- A derived label for the deduction, if we think it matches a common deduction such as

Federal Income Tax,Medicare, orSocial Security. The same asrawLabelif we are unable to match a common deduction.

earnings[Earnings]An array ofEarningsobjects, describing paycheck earnings such as bonuses and reimbursements. Not all earnings will have bothamountandytdAmountavailable. We will extract all values available to us in the payroll system.Child Properties

Required Properties

categorystring- Category of the earning such as

benefit,bereavement,bonus,commission,disability,holiday,other,overtime,per diem,reimbursement,retropay,sick,tip,vacation, orwage. rawLabelstring- The label for the earning, exactly as given by the payroll provider.

Optional Properties

amountnumberThe amount of the earning, in dollars, if provided by the payroll system.ytdAmountnumberThe year to date amount of the earning, in dollars, if provided by the payroll system.hoursnumberThe number of hours used to calculate the total amount of the earning in this statement.ratenumberThe hourly rate of the earning, in dollars.netAmountAdjustments[NetAmountAdjustment]paystubobjectAn object containing fields of_idandurl. Theurlfield can be used to download a PDF and is valid for 1 hour. If theurlexpires, you can get a new one using the generate file URL endpoint.parsedDataobjectAn object containing data parsed from the user's paystub PDF. This field is currently in Beta.Child Properties

Optional Properties

datestringDate of the deposit in ISO 8601 format.grossAmountnumberGross dollar amount of the deposit.hoursnumberHours worked within the pay period.netAmountnumberNet dollar amount of the deposit.payPeriodEndDatestringEnding date of the pay period in ISO 8601 format.payPeriodStartDatestringStarting date of the pay period in ISO 8601 format.ytdGrossAmountnumberYear to date gross dollar amount of the deposit.ytdNetAmountnumberYear to date net dollar amount of the deposit.paymentMethodstringMethod used for the payment. These will be the raw value parsed from the paystubdeductions[Deduction]An array ofDeductionobjects, describing paycheck deductions such as taxes and benefits. Not all deductions will have bothamountandytdAmountavailable. We will extract all values available to us in the PDF.earnings[Earnings]An array ofEarningsobjects, describing paycheck earnings such as bonuses and reimbursements. Not all earnings will have bothamountandytdAmountavailable. We will extract all values available to us in the pdf.Child Properties

Optional Properties

categorystringCategory of the earning.amountnumberThe amount of the earning, in dollars.ytdAmountnumberThe year to date amount of the earning, in dollars.hoursnumberThe number of hours used to calculate the total amount of the earning in this statement.ratenumberThe hourly rate of the earning, in dollars.

{

"statements": [

{

"date": "2020-06-15T12:00:00.000Z",

"payPeriodStartDate": "2020-05-27T12:00:00.000Z",

"payPeriodEndDate": "2020-06-12T12:00:00.000Z",

"grossAmount": 1000,

"ytdGrossAmount": 10000,

"netAmount": 800,

"ytdNetAmount": 8000,

"paymentMethod": "deposit",

"hours": 37,

"deductions": [

{

"category": "taxes",

"label": "Federal Income Tax",

"rawLabel": "Federal Income Tax",

"amount": 200,

"ytdAmount": 2000

},

{

"category": "taxes",

"label": "State Income Tax",

"rawLabel": "Utah State Tax",

"amount": 50,

"ytdAmount": 500

},

{

"category": "other",

"label": "Abc corp dd",

"rawLabel": "Abc corp dd",

"amount": 5,

"ytdAmount": 50

}

],

"earnings": [

{

"category": "benefit",

"rawLabel": "Social Security (Disability)",

"amount": 1000

},

{

"category": "bonus",

"rawLabel": "Quarterly Bonus",

"amount": 2000,

"ytdAmount": 6000

},

{

"category": "overtime",

"rawLabel": "Overtime Pay",

"amount": 100,

"ytdAmount": 1000,

"hours": 10,

"rate": 15

},

{

"category": "reimbursement",

"rawLabel": "Gas Card",

"amount": 25.47,

"ytdAmount": 85.74

}

],

"netAmountAdjustments": [

{

"label": "Mileage Reimbursement",

"amount": 25

}

],

"paystub": {

"_id": "60abeff50836730008616fad",

"url": "[ATOMIC-GENERATED-PRESIGNED-S3-URL]"

},

"parsedData": {

"date": "2020-06-15T12:00:00.000Z",

"payPeriodStartDate": "2020-05-27T12:00:00.000Z",

"payPeriodEndDate": "2020-06-12T12:00:00.000Z",

"grossAmount": 1000,

"ytdGrossAmount": 10000,

"netAmount": 800,

"ytdNetAmount": 8000,

"paymentMethod": "deposit",

"hours": 37,

"deductions": [

{

"category": "taxes",

"rawLabel": "Federal Income Tax",

"amount": 200,

"ytdAmount": 2000

},

{

"category": "taxes",

"rawLabel": "Utah State Tax",

"amount": 50,

"ytdAmount": 500

},

{

"category": "other",

"rawLabel": "Abc corp dd",

"amount": 5,

"ytdAmount": 50

}

],

"earnings": [

{

"category": "benefit",

"rawLabel": "Social Security (Disability)",

"amount": 1000

},

{

"category": "bonus",

"rawLabel": "Quarterly Bonus",

"amount": 2000,

"ytdAmount": 6000

},

{

"category": "overtime",

"rawLabel": "Overtime Pay",

"amount": 100,

"ytdAmount": 1000,

"hours": 10,

"rate": 15

},

{

"category": "reimbursement",

"rawLabel": "Gas Card",

"amount": 25.47,

"ytdAmount": 85.74

}

],

"netAmountAdjustments": [

{

"rawLabel": "Mileage Reimbursement",

"amount": 25

}

]

}

},

{

"date": "2020-06-30T12:00:00.000Z",

"payPeriodStartDate": "2020-05-27T12:00:00.000Z",

"payPeriodEndDate": "2020-06-12T12:00:00.000Z",

"grossAmount": 1000,

"paymentMethod": "check",

"hours": 34,

"deductions": [

{

"category": "taxes",

"label": "Federal Income Tax",

"rawLabel": "Federal Income Tax",

"amount": 200

},

{

"category": "taxes",

"label": "State Income Tax",

"rawLabel": "Utah State Tax",

"amount": 50

},

{

"category": "other",

"label": "Abc corp dd",

"rawLabel": "Abc corp dd",

"amount": 5

}

],

"paystub": {

"_id": "60abeff50836730008616fae",

"url": "[ATOMIC-GENERATED-PRESIGNED-S3-URL]"

}

}

]

}Deposit Accounts

accounts[Deposit Account]- An array of deposit account objects.

Child Properties

Required Properties

accountNumberstring- Account number.

routingNumberstring- The ABA routing number.

typestring- Type of account. Possible values include

checking,savings, orpaycard.

Optional Properties

bankNamestringThe name of the bank or financial institution providing the account.distributionTypestringThe type of distribution for the account. Possible values includetotal,percent, orfixed.distributionAmountnumberThe amount being distributed to the account. WhendistributionTypeispercent, the number represents a percentage of the total pay. WhendistributionTypeisfixed, this number represents a fixed dollar amount. This value is not set whendistributionTypeistotal.

{

"accounts": [

{

"routingNumber": "123123123",

"accountNumber": "1122330000",

"type": "checking",

"bankName": "Molecular Bank",

"distributionType": "percent",

"distributionAmount": 80

},

{

"routingNumber": "456456456",

"accountNumber": "XXXX1111",

"type": "savings",

"bankName": "Molecular Bank",

"distributionType": "percent",

"distributionAmount": 20

}

]

}Employment

employeeTypestring- Employee type. Possible values are

contract,parttime, andfulltime. employmentStatusstring- Employment status. Possible values are

activeandterminated. This value may be derived. jobTitlestring- Employee's job title.

startDatestring- Employee's hire date.

minimumMonthsOfEmploymentnumber- The employee has been employed for at least this number of months. This value may be derived.

weeklyHoursnumber- Number of hours worked per week.

{

"employeeType": "fulltime",

"employmentStatus": "active",

"jobTitle": "Product Manager",

"startDate": "2017-04-19T12:00:00.000Z",

"minimumMonthsOfEmployment": 58,

"weeklyHours": 40,

"employer": {

"name": "Company Inc.",

"address": {

"line1": "12345 Enterprise Rd",

"line2": "Suite 105",

"city": "Salt Lake City",

"state": "UT",

"postalCode": "84111",

"country": "USA"

}

}

}Taxes

taxes[Tax]- An array of tax data objects.

Child Properties

Optional Properties

totalWagesnumberWages, tips and other compensation. Box 1 of the W-2 form.yearstringThe tax year.formobjectAn object containing fields of_idandurl. Theurlfield can be used to download a PDF and is valid for 1 hour. If theurlexpires, you can get a new one using the generate file URL endpoint.parsedDataobjectAn object containing data parsed from the user's tax form PDF. Schemas will be w2 or 1040 depending on the taxtype.W2 parsed data

Optional Properties

taxYearnumberTax year on the W-2.employeeTinstringEmployee's Social Security number or Individual Taxpayer Identification Number.employerTinstringEmployer Identification Number (EIN).employerNameAddressobjectEmployer's name and address.controlNumberstringBox D, control number.employeeNameobjectemployeeAddressobjectEmployee's address.wagesnumberBox 1, Wages, tips, other compensation.federalTaxWithheldnumberBox 2, Federal income tax withheld.socialSecurityWagesnumberBox 3, Social security wages.socialSecurityTaxWithheldnumberBox 4, Social security tax withheld.medicareWagesnumberBox 5, Medicare wages and tips.medicareTaxWithheldnumberBox 6, Medicare tax withheld.socialSecurityTipsnumberBox 7, Social security tips.allocatedTipsnumberBox 8, Allocated tips.dependentCareBenefitnumberBox 10, Dependent care benefits.nonQualifiedPlannumberBox 11, Nonqualified plans.codes[Codes]statutorybooleanBox 13, Statutory employee.retirementPlanbooleanBox 13, Retirement plan.thirdPartySickPaybooleanBox 13, Third-party sick pay.other[Other]stateTaxWithholding[State Tax Withholding]localTaxWithholding[Local Tax Withholding]1040 parsed data

Optional Properties

additionalChildTaxCreditstringBox 28, additional child tax credit.adjustedGrossIncomenumberBox 11, adjusted gross income.americanOpportunityCreditstringBox 29, american opportunity credit.amountOwednumberBox 37, amount owed.capitalGainnumberBox 7, capital gains.childTaxCreditnumberBox 19, child tax credit.deductionsnumberBox 12, deductions.dependentsArraydividendsnumberDividends.earnedIncomeCreditstringEarned income credit.federalTaxWithheldnumberFederal tax witheld.filingStatusstringFiling status.firmNamestringFirm namehealthcareCoveredFullYearbooleanWhether or not healthcare is covered in full.incomenumberIncome.iraDistributionsnumberIra distributions.iraTaxableAmountnumberIra taxable amount.otherIncomenumberOther income.pensionnumberPension.pensionTaxableAmountnumberPension Taxable Amount.preparerNamestringPreparer Name.qualifiedDividendsnumberQualified dividends.refundnumberRefund.socialSecurityBenefitsnumberSocial Security benefits.spouseobjectspouseBlindbooleanWether or not the spouse if blind.spouseNameobjectspouseOver65booleanWhether or not the spouse is over 65.taxableInterestnumberTaxable interest.taxExemptInterestnumberTax exempt interest.taxpayerobjecttaxpayerAddressobjectThe address of the tax payer.Child Properties

taxpayerBlindbooleanWhether or not the taxpayer is blind.taxpayerNameobjecttaxpayerOver65booleanWhether or not the taxpayer i over 65.taxPenaltynumberTax penaltytaxYearstringTax year.totalTaxnumberTotal tax.schedule1Schedule1SchemaSchedule 1Child Properties

Optional Properties

taxableRefundsnumberTaxable refunds.alimonyReceivednumberAlimony Received.businessIncomenumberBusiness income.otherGainsnumberOther gains.supplementalIncomenumberSupplemental income.farmIncomenumberFarm income.unemploymentCompensationnumberUnemployment compensation.educatorExpensesnumberEducator expenses.hsaDeductionnumberHSA deductions.movingExpensesnumberMoving expenses.deductableSelfEmploymentTaxnumberDeductable self employment tax.selfEmployedHealthInsuranceDeductionnumberSelf employment health insurance deduction.alimonyPaidnumberAlimony paid.iraDeductionnumberIRA deduction.studentLoanInterestDeductionnumberStudent loan interest deduction.tuitionFeeDeductionnumberTuition fee deduction.schedule2Schedule2SchemaSchedule 2Child Properties

Optional Properties

altMinimumTaxnumberAlternative minimum tax.selfEmploymentTaxnumberSelf employment tax.unreportedSocialSecurityMeidcareTaxnumberUnreported social security medicare tax.additionalIraTaxnumberAdditional IRA tax.householdEmploymentTaxnumberHousehold employment tax.homeCreditClaimednumberHome credit claim.additionalMedicareTaxnumberAdditional medicare tax.netInvestmentIncomeTaxnumberNet investment income tax.additionalTaxnumberAdditional tax.notRequiredbooleanWether or not additional IRA tax is not required.schedule3Schedule3SchemaSchedule 3Child Properties

Optional Properties

foreignTaxCreditnumberForeign tax credit.childTaxCreditnumberChild tax credit.educationCreditnumberEducation credit.retirementSavingsnumberRetirement savings.totalNonrefundableCreditsnumberTotal non refundable credits.appliedEstimatedTaxnumberApplied estimated tax.premiumTaxCreditnumberPremium tax credit.excessSocialSecurityTaxnumberExcess social security tax.scheduleAScheduleASchemaSchedule AChild Properties

Optional Properties

medicalExpensesnumberMedical expenses.medicalAginumberMedical agi.medicalPercentnumberMedical percent.medicalDeductionnumberMedical deduction.stateLocalTaxesnumberState local taxes.stateLocalIncomenumberState localincome.generalSalesTaxnumberGeneral sales tax.realEstateTaxnumberReal estate tax.personalPropertyTaxnumberPersonal property tax.otherTaxesnumberOther taxes.stateLocalTaxesDeductionnumberState local taxes deduction.homeMortgageInterestPointsnumberHome mortgage interest points.homeMortgageInterestNotReportednumberHome mortgage interest not reported.mortgageInsurancenumberMortgage insurance.investmentInterestnumberInvestment interest.interestPaidDeductionnumberInterest paid deduction.charityCashCheckGiftsnumberCharity cash check gifts.charityNonCashGiftsnumberCharity non cash gifts.charityCarryovernumberCharity carry over.charityDeductionnumberCharity deduction.casualtyTheftLossesnumberCasualty theft losses.otherItemizedDeductionsnumberOther itemized deductions.totalItemizedDeductionsnumberTotal itemized deductions.scheduleBScheduleBSchemascheduleCScheduleCSchemaSchedule CChild Properties

Optional Properties

einnumberEmployment identification number.accountingMethodstringAccounting method.businessProductstringBusiness product.codestringCode.grossReceiptsSalesnumberGross receipts SalescostOfGoodsSoldnumberCost of goods sold.totalGrossIncomenumberTotal gross income.advertisingnumberAdvertising.vehicleExpensesnumberVehicle expenses.commisionsFeesnumberCommisions fees.contractLabornumberContract labor.depletionnumberDepletion.depreciationnumberDepreciation.employeeBenefitsnumberEmployee benefits.insurancenumberInsurance.mortageInterestnumberMortgage interest.otherInterestnumberOther interest.legalProfessionalServicesnumberLegal professional services.officeExpensesnumberOffice expenses.pensionProfitSharingnumberPension profit sharing.rentVehicleMachinerynumberRent vehicle machinery.rentOtherPropertynumberRent other property.repairsnumberRepairs.suppliesnumberSupplies.taxesLicensesnumberTaxes licenses.travelnumberTravel.mealsEntertainmentnumbermeals entertainment.utilitiesnumberUtilities.wagesnumberWages.otherExpensesnumberOther expenses.totalExpensesnumberTotal expenses.tentativeProfitnumberTentavie profit.homeOfficenumberHome office.netProfitnumberNet profit.businessMilesnumberBusiness miles.totalOtherExpensesnumberTotal other expenses.scheduleDScheduleDSchema

{

"taxes": [

{

"type": "w2",

"year": "2020-01-01T00:00:00.000Z",

"totalWages": 50000,

"form": {

"_id": "60abeff60836730008616faf",

"url": "[ATOMIC-GENERATED-PRESIGNED-S3-URL]"

},

"parsedData": {

"taxYear": 2022,

"employeeTin": "XXX-XX-1234",

"employerTin": "12-3456789",

"employerNameAddress": {

"name1": "Tax Form Issuer, Inc",

"line1": "12021 Sunset Valley Dr",

"line2": "Suite 230",

"city": "Preston",

"state": "VA",

"postalCode": "20191"

},

"controlNumber": "012547 WY/OA7",

"employeeName": {

"first": "Kris",

"last": "Public"

},

"employeeAddress": {

"line1": "1 Main St",

"line2": "Apartment 123",

"city": "Melrose",

"state": "NY",

"postalCode": "12121"

},

"wages": 44416.74,

"federalTaxWithheld": 6907.16,

"socialSecurityWages": 47162.92,

"socialSecurityTaxWithheld": 2924.1,

"medicareWages": 47162.92,

"medicareTaxWithheld": 683.86,

"socialSecurityTips": 134.25,

"allocatedTips": 149.75,

"dependentCareBenefit": 543.25,

"nonQualifiedPlan": 354.23,

"codes": [

{

"code": "C",

"amount": 301.5

},

{

"code": "D",

"amount": 2746.18

},

{

"code": "DD",

"amount": 4781.88

}

],

"statutory": false,

"retirementPlan": true,

"thirdPartySickPay": false,

"other": [

{

"description": "Housing",

"amount": 6500

},

{

"description": "Union Dues",

"amount": 1500

}

],

"stateTaxWithholding": [

{

"stateTaxWithheld": 1726.78,

"state": "OH",

"stateTaxId": "OH 036-133505158F-01",

"stateIncome": 44416.74

}

],

"localTaxWithholding": [

{

"localTaxWithheld": 427.62,

"localityName": "Kirtland",

"state": "OH",

"localIncome": 44416.74

}

]

}

},

{

"type": "1040",

"year": "2020-01-01T00:00:00.000Z",

"form": {

"_id": "672929f30dcd9d16bb5c4c62",

"url": "[ATOMIC-GENERATED-PRESIGNED-S3-URL]"

},

"parsedData": {

"additionalChildTaxCredit": null,

"adjustedGrossIncome": 500000,

"americanOpportunityCredit": null,

"amountOwed": null,

"capitalGain": 500,

"childTaxCredit": 1234,

"deductions": 25000,

"dependents": [

{

"firstName": "Johnny",

"lastName": "Doe",

"suffix": "Jr.",

"relationship": "son"

},

{

"firstName": "Alice",

"lastName": "Doe",

"relationship": "daughter"

},

{

"firstName": "Janice",

"lastName": "Doe",

"relationship": "daughter"

},

{

"firstName": "Bobby",

"lastName": "Doe",

"relationship": "son"

}

],

"dividends": 250,

"earnedIncomeCredit": null,

"federalTaxWithheld": 19536,

"filingStatus": null,

"firmName": "Self-Prepared",

"healthcareCoveredFullYear": null,

"income": 1000000,

"iraDistributions": 1234,

"iraTaxableAmount": 1234,

"pension": 1234,

"pensionTaxableAmount": null,

"preparerName": "Mr. Accountant",

"refund": null,

"socialSecurityBenefits": 1234,

"spouse": {

"occupation": "Lawyer",

"phone": null

},

"spouseBlind": true,

"spouseName": {

"first": "Jane",

"middle": "E.",

"last": "Doe"

},

"spouseOver65": true,

"taxpayer": {

"ssn": "111-22-3333",

"occupation": "Software Engineering Manager",

"phone": "(111)111-1111"

},

"taxpayerAddress": {

"line1": "123 somewhere ln",

"line2": "1234",

"city": "Layton",

"state": "UT"

},

"taxpayerBlind": null,

"taxpayerName": {

"first": "John",

"middle": "M",

"last": "Doe",

"suffix": "III"

},

"taxpayerOver65": null,

"taxPenalty": null,

"taxYear": "2022",

"totalTax": 17863,

"schedule1": {

"taxableRefunds": 123456,

"alimonyReceived": 456789,

"businessIncome": 123,

"otherGains": 123456,

"farmIncome": 456789,

"unemploymentCompensation": 123456,

"educatorExpenses": 123456,

"hsaDeduction": 456789,

"movingExpenses": 123,

"deductableSelfEmploymentTax": 456,

"selfEmployedHealthInsuranceDeduction": null,

"alimonyPaid": 123,

"iraDeduction": 456,

"tuitionFeeDeduction": null

},

"schedule2": {

"altMinimumTax": 123,

"selfEmploymentTax": 456,

"unreportedSocialSecurityMeidcareTax": 789,

"additionalIraTax": null,

"householdEmploymentTax": 0,

"homeCreditClaimed": 123,

"additionalMedicareTax": 456,

"netInvestmentIncomeTax": 789,

"additionalTax": 0,

"notRequired": null

},

"schedule3": {

"foreignTaxCredit": 123,

"childTaxCredit": 123,

"educationCredit": 123,

"retirementSavings": 123,

"totalNonrefundableCredits": 123,

"appliedEstimatedTax": null,

"premiumTaxCredit": 123,

"excessSocialSecurityTax": 123

},

"scheduleA": {

"medicalExpenses": 123,

"medicalAgi": 123,

"medicalPercent": 123,

"medicalDeduction": 123,

"stateLocalTaxes": null,

"stateLocalIncome": 123,

"generalSalesTax": 123,

"realEstateTax": 456,

"personalPropertyTax": 789,

"otherTaxes": 123,

"stateLocalTaxesDeduction": 123,

"mortgageInsurance": null,

"charityCashCheckGifts": 123,

"charityNonCashGifts": 123,

"charityCarryover": 456,

"charityDeduction": 123,

"casualtyTheftLosses": 123,

"otherItemizedDeductions": 123,

"totalItemizedDeductions": 123

},

"scheduleB": {

"hadForeignAccount": true,

"foreignAccountCountries": "El Salvador, Nicaragua, Mongolia, Atlantis"

},

"scheduleC": {

"line1Checkbox": false,

"businessName": "My Second Business LLC",

"ein": 123456789,

"address": {

"line1": "123 Business Drive",

"city": null

},

"accountingMethod": "some other method",

"businessProduct": "My First Business LLC",

"code": "12345",

"grossReceiptsSales": null,

"costOfGoodsSold": 123,

"totalGrossIncome": 123,

"advertising": 123,

"vehicleExpenses": 456,

"commisionsFees": 789,

"contractLabor": 123,

"depletion": 456,

"depreciation": 789,

"employeeBenefits": 123,

"insurance": 456,

"legalProfessionalServices": 456,

"officeExpenses": 789,

"pensionProfitSharing": 123,

"rentVehicleMachinery": 456,

"rentOtherProperty": 789,

"repairs": 123,

"supplies": 456,

"taxesLicenses": 789,

"travel": 123,

"mealsEntertainment": 456,

"utilities": 789,

"wages": 123,

"otherExpenses": 456,

"totalExpenses": 789,

"tentativeProfit": 123,

"homeOffice": 456,

"netProfit": 789,

"businessMiles": 123456,

"totalOtherExpenses": 123

},

"scheduleD": {

"shortTermCapitalGain": 128,

"longTermCapitalGain": 267

},

"scheduleE": {

"rentalProperty": [

{

"postalCode": " 11111"

},

{

"postalCode": " 11111"

},

{

"postalCode": " 11111"

}

]

}

}

}

]

}Identity

firstNamestring- First name.

lastNamestring- Last name.

dateOfBirthstring- Date of birth in ISO 8601 format.

emailstring- Email address.

phonestring- Phone number.

ssnstring- Social security number.

addressstring- Street address of the user's address.

citystring- Address city.

statestring- Address state.

postalCodestring- Address postal code.

{

"firstName": "Jane",

"lastName": "Appleseed",

"dateOfBirth": "1984-04-12T12:00:00.000Z",

"email": "janeappleseed@example.com",

"phone": "5558881111",

"ssn": "111223333",

"address": "123 Example St.",

"city": "Salt Lake City",

"state": "UT",

"postalCode": "84111"

}Timesheets

typestring- Type of timesheet entry is one of

paid,unpaid, orscheduled. durationnumber- The amount of time, in minutes.

datestring- The date of the timesheet entry in ISO 8601 format.

clockedInstring- The ISO 8601 datetime string of when the user clocked in.

clockedOutstring- The ISO 8601 datetime string of when the user clocked out.

[

{

"duration": 420,

"date": "2021-10-13T12:00:00.000Z",

"type": "unpaid",

"clockedIn": "2021-10-13T13:00:00.000Z",

"clockedOut": "2021-10-13T20:00:00.000Z"

},

{

"duration": 480,

"date": "2021-10-12T12:00:00.000Z",

"type": "paid",

"clockedIn": "2021-10-12T13:00:00.000Z",

"clockedOut": "2021-10-12T21:00:00.000Z"

},

{

"duration": 340,

"date": "2021-10-11T12:00:00.000Z",

"type": "paid",

"clockedIn": "2021-10-11T13:00:00.000Z",

"clockedOut": "2021-10-11T18:40:00.000Z"

}

]Output Metadata

The outputMetadata object will serve to replace and enhance the derivedOutputMetadata object, which is now deprecated and will be fully sunset in the future.

This object contains information on how each field of the outputs object was obtained. Each key of the outputMetadata object will correspond to a field in the outputs object using path based notation for nested fields. The value of each key will contain an object with a key sourcedFrom. The value of sourcedFrom will be one of: api, web, paystub, or derived.

When the outputMetadata object is not present, it is assumed that the fields are sourced via api or web. The outputMetadata object will be included as a child of the data object, contained within the webhook events for that Task.

{

"outputMetadata": {

"annualIncome": {

"sourcedFrom": "derived"

},

"paycyle": {

"sourcedFrom": "derived"

},

"statements.0.grossAmount": {

"sourcedFrom": "paystub"

}

},

"outputs": {

"income": 45154.92,

"incomeType": "yearly",

"annualIncome": 45154.92,

"hourlyIncome": 21.64,

"payCycle": "semimonthly",

"employmentStatus": "terminated",

"minimumMonthsOfEmployment": 1,

"nextExpectedPayDate": "2020-06-30T12:00:00.000Z",

"statements": [

{

"date": "2020-06-15T12:00:00.000Z",

"payPeriodStartDate": "2020-05-27T12:00:00.000Z",

"payPeriodEndDate": "2020-06-12T12:00:00.000Z",

"grossAmount": 1875,

"hours": 86.66

},

{

"date": "2020-05-31T12:00:00.000Z",

"payPeriodStartDate": "2020-05-11T12:00:00.000Z",

"payPeriodEndDate": "2020-05-26T12:00:00.000Z",

"grossAmount": 1875,

"hours": 86.66

}

]

},

"derivedOutputMetadata": {

"annualIncome": {},

"hourlyIncome": {},

"netHourlyRate": {},

"payCycle": {},

"employmentStatus": {},

"minimumMonthsOfEmployment": {},

"nextExpectedPayDate": {},

"currentPayPeriodStart": {},

"currentPayPeriodEnd": {},

"unpaidHoursInPayPeriod": {}

}

}